Market Report 1: Q4 2022 Vancouver Office Figures

BOMA BC Review:

- Colliers Q4 Vancouver Office Market Report 2022

- Colliers National Office Market Snapshot Q4 2022

- CBRE Canada Office Figures Q4 2022

- Cushman and Wakefield Q4 2022 Vancouver Office Market Report

- Avison Young Canada Year-End 2022 Office Market Report

Highlights:

- The Suburban vs. Downtown Market:An increasing demand for suburban office space in the Lower Mainland.

- The Stack and Vancouver Centre II:A glut of new supply in downtown Vancouver is contributing to increased vacancy rates.

- Vancouver’s tech industry:Increasing subletting from technology companies due to changing needs.

- New tenant preferences:Post-pandemic dynamics are shifting employee office space requirements.

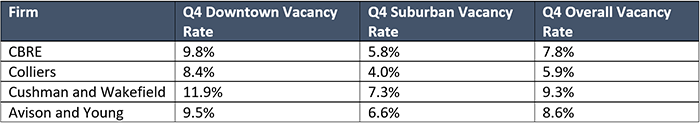

Vancouver remains one of Canada’s strongest office leasing markets in the country. There is a market consensus that Vancouver is highly competitive with the lowest nationwide office vacancy rates, and recording positive net absorption rates this quarter, despite an influx of subleasing activity.

However, market research reports are all recognizing the same underlying trends this quarter. Specifically, Downtown Vancouver vacancy rates have been steadily climbing since Q1 2020 at the start of the pandemic, and this trend continued this quarter for several reasons.

The growing suburban market:

The move towards suburban office space in Vancouver, and nationwide, continues to take root.

In Colliers and CBRE’s National Snapshots, both noted that a strengthening suburban market is a nationwide trend, not just in Vancouver. Colliers noted that more transit-dependent areas with larger population centres in Canada performed worse than smaller cores. [1] CBRE’s National Snapshot noted that in major markets across Canada, tenants are prioritizing flexibility when it comes to commute times, and the delta between downtown and suburban markets is at it’s “widest point to date.” [2]

Vancouver is no exception. CBRE noted that the continued strength of Vancouver’s suburban market is starting to demonstrate a “divide” between downtown and suburban markets as employers continue to seek space outside the core. [3]

Cushman and Wakefield’s Vancouver explained the phenomenon by noting that “suburban markets have become more attractive to tenants wanting to locate closer to where employees may reside.” [4]

New supply:

While several factors are contributing to changing vacancy levels, several Market Reports noted the impact of new supply on Vancouver’s market as over 830,000 SQFT of office space was added in 2022.

Cushman and Wakefield and CBRE both noted that the addition of new supply in downtown Vancouver was an important contributor to the increasing vacancy rate – specifically the newly built Vancouver Centre II and the Stack. [5] [6] Cushman and Wakefield noted that for the first time in several years, there are now numerous class A and AAA options in the downtown core.

While Colliers noted that Vancouver is undergoing an “office construction boom,” adding 500,000 SQFT of office space this quarter alone, they attributed less importance to new supply on vacancy rate as other market reports.

Sublease activity and the tech industry:

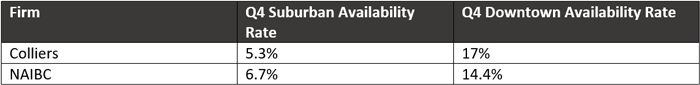

Subleasing activity in the downtown core had a substantial impact on vacancy rate and the availability rate. Market report data was unanimous in showing that Vancouver leads the country in sublets as a percentage of vacancy.

Colliers noted that subleasing activity was a key driver of Vancouver’s increased vacancy rate, as the downtown core received a “significant influx” of sublease space in Q4.

Cushman and Wakefield noted that tech is one of the most significant industries for the downtown Vancouver Market, representing nearly 40% of the office leasing market for the last decade. The highest amount of sublease space, according to that report, is attributable to the tech industry, which is facing its own challenges and unique circumstances.

Cushman and Wakefield noted that increased subleasing activity downtown is part of a larger trend as companies prioritize attracting employees who want shorter commute times in suburban markets.

Tenant Preferences:

The influx of subleasing space is starting to put tenants in the driver’s seat.

CBRE noted an emerging nationwide trend in which downtown tenants seek out higher quality spaces to retain employees and ensure a continued return to the office following the pandemic. Since the pandemic, CBRE has noted that Class B vacancy is rising twice as fast as class A vacancy in downtown markets.

Conversely, according to CBRE, suburban tenants are prioritizing shorter commute times over office quality, as suburban Class A vacancy is higher than Class B vacancy nationwide.

Colliers noted that as the amount of sublease space increases in the Greater Vancouver Area, landlords are offering incentives to potential tenants including offering rent-free periods or subsidizing leasehold improvements.

Source links:

[1] https://www.collierscanada.com/en-ca/research/national-market-snapshot-2022-q4

[2] https://www.cbre.ca/-/media/project/cbre/dotcom/americas/canada-emerald/insights/Figures/Office/Canada_Office_Figures_Q4_2022.pdf

[3] https://www.cbre.ca/-/media/project/cbre/dotcom/americas/canada-emerald/insights/Figures/Office/Canada_Office_Figures_Q4_2022.pdf

[4] https://www.cushmanwakefield.com/en/canada/insights/canada-marketbeats/vancouver-marketbeats (Office Market)

[5] https://www.cushmanwakefield.com/en/canada/insights/canada-marketbeats/vancouver-marketbeats (Office Market)

[6] https://www.cbre.ca/-/media/project/cbre/dotcom/americas/canada-emerald/insights/Figures/Office/Canada_Office_Figures_Q4_2022.pdf