BOMA BC Advocacy Update 2: Small Business Tax Relief

On October 3rd, 2022, the Province of BC announced a proposal to provide tax relief for small businesses paying disproportionately high taxes on development potential. As potential solutions could have had ramifications for the commercial real estate industry, BOMA BC has been an active and engaged stakeholder on this issue. We will follow its implementation very closely.

Over the last number of years, there have been several media stories regarding small businesses in under-developed properties struggling with paying the highest and best use taxes on development potential, and municipal and provincial governments have sought to find a solution. This announcement is the outcome of a property tax assessment review launched in 2019.

How does it work?

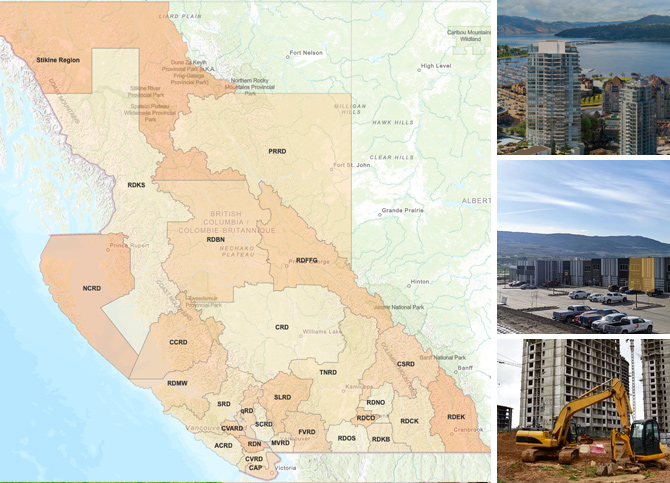

If this legislation passes, the Province will give municipalities a tool to address tax rates. The Municipalities will be able to identify what types of properties or areas in their municipality are affected by high-density development potential and provide relief to the commercial properties that need it most by taxing the assessed value of the land at a reduced municipal tax rate.

BOMA BC Response and Advocacy

BOMA BC has been an active participant on this file since consultations began in 2019. In Spring 2022, the Province of BC restarted stakeholder consultations, and BOMA BC provided feedback and informed the Province how to construct a productive solution that did not have negative repercussions for the rest of the industry. We consulted with our membership and relayed the feedback to the Province, Department of Finance officials, and eventually BC’s Minister of Finance.

Specifically, our advocacy work strongly encouraged the Province to develop a proposal that was targeted, focused, and provided relief directly to small businesses, rather than penalizing the commercial real estate industry as a whole. This is a challenging issue for some small businesses, and we reiterated the importance of focusing on relief for those businesses. We are encouraged from that perspective, but we would like to see meaningful tax relief for small business owners upon implementation.

As this proposal will need to be implemented and structured by Municipalities, it is too early to comment on the merits of the legislation.

To determine the effectiveness of this proposal, BOMA BC will want to know:

- How is this different from the Revitalization Tax Exemption?

- Will any tax deductions be balanced by tax hikes on the remaining balance commercial properties?

- Do municipalities support the program, will they implement it, and what criteria will they set?