Market Report: Q1 2023 Vancouver Office Figures

BOMA BC Review:

- JLL Q1 2023 Office Insight Metro Vancouver

- Colliers Vancouver Office Market Report Q1 2023

- CBRE Canada Office Figures Q1 2023

- Avison and Young Q1 2023 Vancouver Office Market Report

- Cushman and Wakefield Q1 Vancouver Office Report

Highlights:

- Vacancy rates continue to rise: Double-digit vacancy rates for the first time in decades.

- Looming recession and interest rates give pause: Troubling economic indicators fueling the fire.

- Flight to high-quality office space: Yaletown’s Class C Vacancy Rate almost 30%.

- Absorption rates accuracy: Is new Class A supply downtown masking deeper challenges?

- Unchanged Rents: Stable rents are not dropping despite high vacancies.

As reported in last quarter’s Vancouver Office update, the Metro Vancouver office market continues to face headwinds, particularly downtown. Companies continue to re-evaluate office space requirements, the tech sector continues to face challenges, and macro economic trends are posing challenges to the market.

While the same trends that led to challenges in Q4 2022 continue to persist, they are presenting themselves differently in different neighborhoods and regions across Metro Vancouver.

It is important to note, that all market watchers agree that Vancouver remains one of the strongest performing office markets nationwide. Vancouver’s office vacancy rate is one of the lowest in North America.

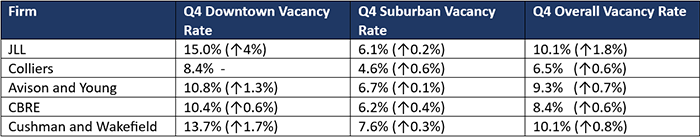

Metro Vancouver Office Vacancy Rates

Record High Vacancy Rates

The rising office vacancy rates in urban centres across North America has been reported widely, and Vancouver is no different.

There is a consensus amongst market watchers that vacancy rates are ticking up across Metro Vancouver in the first quarter of 2023, continuing a troubling trend that we’ve seen since the start of the pandemic.

According to Avison Young, Downtown Vancouver’s office vacancy rate of 10.8% (up from 9.6% last quarter), is the highest it’s been in nearly 20 years. Cushman and Wakefield noted that it’s the highest it’s been in 30 years.

Subleasing remains a key factor contributing to rising vacancy rates, largely because of a struggling technology sector and a persistent hybrid work environment. Avison and Young noted that downtown Vancouver saw a 34% increase in sublease vacancy since last quarter, and Cushman and Wakefield noted that sublease supply reached its highest level in over 20 years.

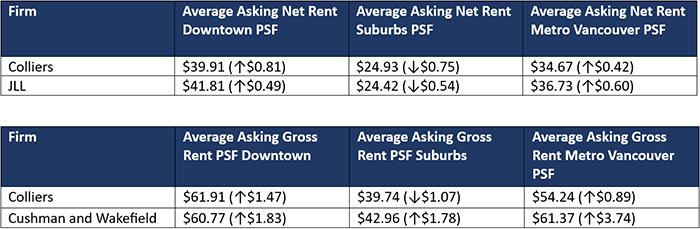

Asking rents remaining resilient

All firms agreed the asking rental rates in Metro Vancouver are resilient, despite a challenging environment.

There is a consensus that the addition of higher quality office space is contributing to the increase in average rent, particularly Class AAA buildings like Bosa Waterfront, The Stack or Deloitte Summit.

JLL noted the demand for higher quality office space contributed to an increase in average net rents in Metro Vancouver, and Cushman and Wakefield also stated that new construction is driving higher asking rates, noting that Class AAA buildings like the Stack and BOSA Waterfront increased downtown Class A and AAA asking rates by 2.7% since last quarter.

According to Colliers, “The GVA weighted average office asking net rent remained stable…part of this is because of an influx of space in better quality office buildings, some of which were newly delivered to the market.” [1]

Colliers also noted that a substantial supply of Class A office space in the suburbs is also stabilizing average asking rents across the region.

However, Avison and Young pointed out that Downtown was the only market that noted positive absorption rates (because of new supply coming online), which may explain the slight dip in asking rates in the suburbs compared to downtown.

Macroeconomic Trends Dampening Office Market

While factors such as the hybrid work environment and a struggling technology sector are contributing to rising vacancy rates, general economic uncertainty is also dampening the market.

According to Colliers, Avison and Young, and JLL, a potential recession, rising interest rates, and financial sector volatility, are causing companies to slow down or re-evaluate business decisions.

- “Many companies are pausing decision making on their space requirements until there are stronger positive economic indications, resulting in a lower volume of transactions - Colliers” [2]

- “Deal velocity across Metro Vancouver remained constrained amid high costs of debt - Avison and Young” [3]

- “Coupled with financial sector volatility its clear why many developers have paused their plans and office users are reassessing their needs - JLL” [4]

Continued Demand for High Quality Office Space

In our last quarterly office market update, we noted a trend in which downtown office tenants are seeking out higher quality spaces to retain employees and ensure a continued return to the office following the pandemic. This is evidenced by troubling trends in Yaletown, along with Absorption rates.

According to Avison and Young, the flight to quality trend has become the most pronounced in Yaletown. Painting a far grimmer picture than other market watchers, Avison and Young notes that Yaletown has an overall vacancy rate of 15.9%, with Class C vacancies at an astonishing 28.6%. Avison and Young has noted that Yaletown has a significant amount of Class C “shell space” that is no longer desirable, in addition to the rest of its Class C office space.

JLL also noted the demand for higher quality office space, and the “flight to quality trend” by looking at Absorption Rates. According to JLL, the strong Class A absorption rate in Metro Vancouver compared to a negative Class B and C absorption rate “indicates the persistence of the flight to quality trend in the Vancouver office market.”

What do strong Absorption numbers tell us?

While Metro Vancouver posted strong absorption numbers this quarter (partially as a result of the flight to Class A buildings downtown), several market watchers added the caveat that an exceptional amount of new supply downtown may be skewing the numbers.

JLL noted that the completion of the Stack, BOSA Waterfront, and the Post, contributed to strong Class A Absorption downtown. Colliers agreed that record level of new absorption in Metro Vancouver this quarter was due to the “exceptional” amount new Class A supply. “Without these fully-leased buildings coming online this quarter, noted Colliers, absorption in the downtown market would have been negative.” [5]

Avison and Young specifically highlighted negative absorption numbers in all submarkets except downtown.

Source links:

[1] Colliers Vancouver Office Market Report Q1 2023

[2] Colliers Vancouver Office Market Report Q1 2023

[3] Avison and Young Vancouver Office Market Report Q1 2023

[4] JLL Office Insight Vancouver Q1 2023

[5] Colliers Vancouver Office Market Report Q1 2023