Market Report: Q1 2024 Vancouver Office Figures (Members Only)

BOMA BC Review:

- Colliers Q1 2024 Vancouver Office Market Report

- CBRE Q1 2024 Canada Office Figures

- Cushman and Wakefield Q1 2024 Vancouver Office Report

- NAI Commercial Q1 2024 Vancouver Office Report

Highlights:

- Flight to quality persists: Tenants continue to prioritize higher class properties.

- Sublease preferred over headlease: Market uncertainty drawing tenants to fitted out spaces..

- Office Conversions: While not as common, we are seeing rising conversion activity.

As we enter the first quarter of 2024, Vancouver’s office market remained generally stable.

While Vacancy rates and rents remain stable, they are still elevated compared to pre-pandemic figures.

However, the precarious nature of the office market continues to play out in many ways, impacting tenant preferences, the sub lease market and construction decisions.

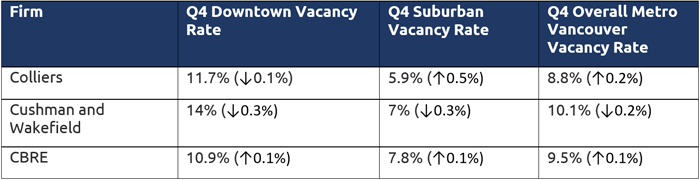

Metro Vancouver Office Vacancy Rates

Flight to Quality

A trend since coming out of the pandemic has been the flight to quality. As employers look to lure tenants back to the office, they are prioritizing better amenities and Class A properties.

In previous reports, we’ve noted declining net rent for Class C properties in the Downtown Core, increasing Class C availability rates, and significantly elevated vacancy rates in pockets of Yaletown and Gastown.

This quarter, some significant transactions were further indication of the flight to quality trend.

Cushman and Wakefield noted some significant examples of flight to quality. For example, Grant Thornton has leased two floors at the brand new VCII, upgrading from an older Class A building.

Colliers also noted the significant impact flight to quality is having on the office market. According to Colliers, 25% of all available spaces were found in only 10 buildings. Colliers noted that this could be the result of companies relocating to newly completed buildings.

Cushman and Wakefield also noted how the drastic flight to quality is impacting absorption rates. According to Cushman and Wakefield, Downtown Vancouver experienced negative absorption this quarter as a result of tenants relocating to new builds out of older Class A and B buildings. For example, Fluor Canada, Pan American Silver, and Sandstorm Gold all relocated to AAA new builds.

Preference for Sublease over Headlease – Differing Opinions

Market uncertainty continues to play out in different ways across the Metro Vancouver Office Market, particularly tenant preferences. While market watchers all agreed that uncertainty is playing out, they disagreed how.

Sublease versus headleases have been a common point of discussion in the new office market environment, as tenants adjust to new remote work realities. In previous reports, we discussed how sublease space available in Vancouver had reached record highs.

Colliers had a different perspective on the sublease market this quarter compared to other market watchers.

According to Colliers, the market prefers sublease spaces. This has resulted in a “growing share of headlease spaces remaining in the market as options.” [1]

Colliers also noted this contributed to rising vacancy this quarter, as some tenants prefer not to enter into new headleases.

Colliers noted that tenants favour sublease options because of continued uncertainty around return to office.

This is evidenced by sublease spaces spending only 280 days on the market, compared to 1 year for headlease.

However, other market watchers disagreed, and noted that sublease space is actually declining. NAI Commercial noted that subleases are decreasing as terms are beginning to expire, and tenants are leasing smaller spaces.

Cushman and Wakefield also noted that subleasing activity is declining this quarter.

According to Cushman, tenants are continuing to reassess their real estate needs, leading to a reduced demand for office space.

Nonetheless, Cushman and Wakefield noted how the technology sector is the leading sector in the sublease space.

“In Metro Vancouver, our survey of all available sublease spaces over 10k sf highlighted tech industry as the leading sector, constituting 42% of the total, as they continue to adapt to hybrid work models.” [2]

Technology, more than most sectors, has had to adjust to hybrid work models, and therefore, may prefer the flexibility of sublease options over headlease.

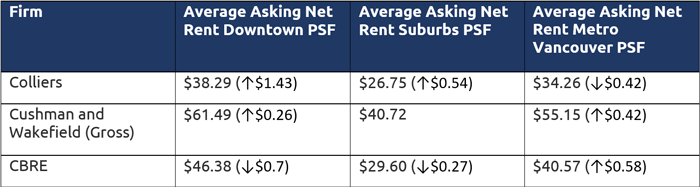

Metro Vancouver Asking Rents

There has been a wide gulf in downtown versus suburban vacancy rates. This appears to be playing out in rental rate growth as well.

When comparing year over year rental rates, rates have increased 8% in the suburban market, while decreasing 4% downtown, according to Colliers.

Office Conversions

The office market has undergone significant change since the pandemic. To adapt, some building owners have converted offices into different uses across North America, and local governments have incentivized and subsidized conversions.

Unlike other markets, Vancouver has had very minimal office conversions. We have a comparatively lower vacancy rate, and no local government incentive programs.

BOMA BC has met with the City of Vancouver to discuss office conversions. City Staff have noted that they are not eager to see office to residential conversions in the downtown core, as we don't have the vacancy numbers to support it, and because of the already large numbers of residential properties downtown. They indicated that they may be willing to support office to other types such as hotels or student residences.

According to CBRE, there was 870,000 sqft of office conversions across Canada this quarter, with rising conversion activity in Ottawa and Halifax. Flight to quality has hit Halifax hard, leaving several buildings “obsolete.”

While office conversions are not happening in Vancouver, they are manifesting in other ways.

Cushman and Wakefield, for example, noted office conversions are happening, but during the planning and construction phase.

“There continues to be a trend of converting proposed office developments into hotels or residential properties, as well as scaling them down or delaying them due to financing issues. Outside of downtown Vancouver, there is over 3.8 msf of projects under construction and 9.6 msf proposed. Notably, some of these projects, including those already commenced, are slated to either downsize their office components or undergo conversion into alternative usage types.” [3]

Colliers also noted that while office conversions are not common in Vancouver, rising vacancy is causing many developers to pause developments.

“As a result of rising vacancy and reduced demand for office space, many proposed developments have been placed on hold for reevaluation or chosen to wait to break ground until sufficiently pre-leased, rather than proceeding on a speculative basis.” [4]

Source links:

[1] Colliers Q1 2024 Vancouver Office Market

[2] Cushman and Wakefield Q1 2024 Office Market

[3] Cushman and Wakefield Q1 2024 Office Market

[4] Colliers Q1 2024 Vancouver Office Market