Market Report: Q2 2023 Vancouver Office Figures

BOMA BC Review:

- JLL Q2 Office Insight Metro Vancouver

- Colliers Vancouver Office Market Report

- CBRE Canada Office Figures

- Avison Young Vancouver Office Market Report

- Cushman and Wakefield Q2 Vancouver Office Report

- NAIBC Q2 Office Market Report

Highlights:

- Pockets of Downtown continue to struggle: Flight to quality continues to pose challenges for Yaletown.

- Suburbs holding up the broader market: Suburbs continue to show strength.

- Rising headlease vacancy: What happens when leases expire?

Canada’s office market continues to face headwinds, and Vancouver is no different. According to most market watchers, the second quarter was slow for new tenant leasing.

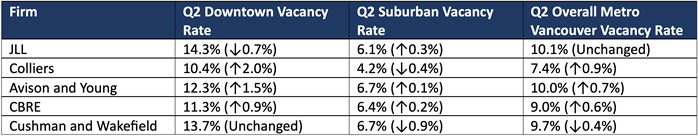

The quarterly reports agreed that vacancy rates continued to slightly tick up this quarter, largely attributable to the Downtown core.

Office quality, tenant preferences, broader macro economic trends, and expiring leases are all impacting vacancy and absorption rates this quarter.

While it is playing out differently in different neighborhoods, Metro Vancouver remains a resilient market. Rents remain stable, and our vacancy rates are in a far better position than other major markets.

Subleasing vs. Head Lease as leases begin to expire:

Vacancy rates continue ticking up across Metro Vancouver in the second quarter of 2023.

In previous quarters, sublets as a percentage of vacancy was the key theme as businesses sublet their space to try and recover some costs from underused properties. And still this quarter, Colliers has noted that Vancouver still has the highest sublease ratio in the country.

However, according to Avison Young, this quarter’s uptick in downtown Vancouver was driven by head lease vacancy, rather than sublease vacancy. In other words, expiring leases that were not renewed or sublet.

Avison Young notes that head lease vacancy accounted for 76% of the total rise in downtown vacant space this quarter. This is a sharp increase from 52% in the first quarter of this year.

For over three quarters of new downtown office vacancies, tenants waited for their lease to expire before walking away and did not sublet earlier.

So why didn’t these properties sublet their property earlier, or renew their lease?

According to Avison Young, possible reasons include spaces built out for tech-based tenants have seen limited demand on the sublease market so other tenants with similar spaces did not try to sublet, and businesses have simply waited for their leases to run out before deciding to pull back on space.

Similarly, JLL noted that the demand for “large-block, built-out sublease space” is limited with full-floor sublease spaces sitting vacant, and year to date downtown sublease absorption is negative at roughly -500,000 SF.

NAIBC also noted that rising vacancy rates are attributable to companies reevaluating spaces as their leases expire. According to NAIBC we will begin to see a shrinking sublease market as leases continue to expire. “A notable increase in unrenewed leases, or tenants right sizing continues to drive vacancy rates up.” [1]

What is happening neighborhood by neighborhood downtown?

In neighborhoods such as Gastown and Yaletown, vacancy rates are now significantly above average for downtown and metro Vancouver

According to Avison Young, Yaletown’s vacancy rate continues to reach all times, reaching 17.3% last quarter, up 1.4% from the previous quarter.

And according to JLL, Gastown’s vacancy rate reached 18.7%, up 0.3% from the previous quarter.

As with most regions, Class C buildings had a much more pronounced vacancy rate. There has been a flight to quality since the pandemic, and Yaletown and Gastown’s mix of older class C buildings have been no exception. JLL noted that Gastown’s Class C vacancy rate climbed to 20.3%, and Avison Young noting that Yaletown’s Class C vacancy climbed to 23.7%.

Metro Vancouver office Vacancy Rates

The Suburban market

In previous market reports, we’ve noted the divide between downtown and suburban markets. As companies continue to adjust to new employee work habits and needs, more and more companies are flocking to suburban office space markets.

Avison Young notes vacancy rates dropped in cities like Richmond, Surrey and New Westminster, with a “burst of deals” in Richmond in particular. Avison Young attributes the continued strength of the suburban market to more affordable deals.

Colliers noted that the types of tenants in the suburban vs. downtown market influences the vacancy rate, with more stable industries typically renting space in the suburbs, and more volatile and growth-oriented industries such as tech, typically occupying downtown space.

Colliers also mentions that new companies entering the suburbs from more stable industries such as insurance, healthcare, professional services and back-office facilities, is driving the suburban vacancy rate down.

Avison Young’s quarterly report was quite bullish on the suburban market, noting that vacancy rates in New Westminster and Langley have dropped to historic lows. Cushman and Wakefield was equally optimistic, referring to Langley as “a landlord’s market” as asking rates increase.

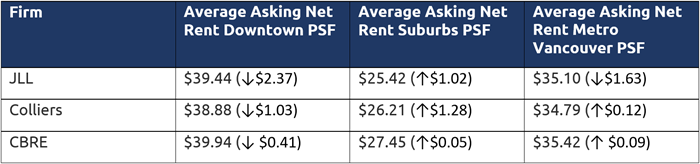

Rents Remain Steady

Colliers, Cushman and Wakefield and JLL all noted the limited movement in asking rents, despite elevated vacancy levels. Market watchers attribute this to the persistent strength of our market.

Colliers did note, however, that asking rents will not remain stable forever if vacancies continue to rise.

However, Cushman and Wakefield did note how flight to quality and strong suburban markets trends continue to impact asking rents, with downtown core class A assets dipping slightly, and suburban markets remaining stable.

Even though rental rates have remained resilient, Colliers has broken down year over year rental rate growth across Metro Vancouver, and the Suburbs have shown 7% growth, while Downtown has declined 1%.

Declining leasing activity and the technology sector

Market watchers all noted declining leasing activity this quarter. Avison Young noted “limited deal velocity downtown,” and CBRE noted a “pause in market activity.”

According to NAIBC, “the second quarter has been described by landlords and leasing agents as slow for new tenant leasing.”

Cushman and Wakefield attributed the decline to a reduced demand from the tech sector.

Colliers also highlighted the struggling tech sector, noting that “the demand for office space in the Greater Vancouver Area by the technology sector has been shrinking, from a peak of 50% among all industries in q4 2021 down to 26% as of Q2 2023.”

Conclusion:

While broader economic trends continue to impact the commercial real estate industry, this is not exclusive to Vancouver. Our market has continued to hold up better than other major markets and this remains an attractive market to invest.

Source links:

[1] NAIBC Q2 Office Market Report