Market Report: Q3 2023 Vancouver Office Figures

BOMA BC Review:

- JLL Q3 Office Insight Metro Vancouver

- Colliers Q3 Vancouver Office Market Report

- CBRE Canada Office Figures

- Cushman and Wakefield Q3 Vancouver Office Report

Highlights:

- Downtown Vancouver no longer the lowest office vacancy rate: Downtown Vancouver falls behind Toronto.

- A tenant’s market: Elevated vacancy rates put tenants in the driver’s seat.

- Healthcare overtakes Technology Sector in Vancouver: Slow leasing activity changing market dynamics.

- Rents are dropping across Metro Vancouver: Stubborn market conditions are forcing landlords to drop asking rates.

The Greater Vancouver office market continues to face headwinds as companies, landlords and tenants continue to adjust to the post-pandemic reality. Vacancy rates remain elevated, and absorption rates were negative this quarter.

Nonetheless, the overall Metro Vancouver vacancy rate remains the strongest in North America with strong return to office levels.

Office quality, tenant preferences, and broader macro economic trends, are all impacting vacancy and absorption rates this quarter.

As the office market continues to soften, we are starting to see rents dip, and we are seeing a tenant’s market.

Elevated Vacancy Rates and Negative Absorption:

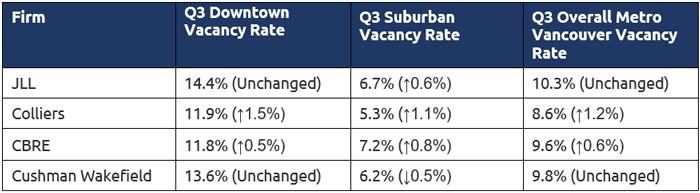

There is a consensus that vacancy rates remained elevated across Metro Vancouver in the third quarter of 2023. While there was some discrepancy in the level of change, there was a consensus that market conditions have not improved.

Colliers noted that Downtown’s Vacancy rose to a 20 year high of 11.9%, with Metro Vancouver’s vacancy at a six year high of 8.6%.

Downtown Vancouver has historically had the lowest office vacancy rate in Canada. According to Colliers, Downtown Vancouver has now fallen behind Downtown Toronto with an 11% vacancy rate this quarter.

Cushman and Wakefield and JLL noted that vacancy rates across Metro Vancouver largely remained flat.

In addition to elevated vacancy rates, negative absorption rates were a key theme this quarter. The absorption rate is the square footage of space leased.

All market watchers noted negative absorption rates across Metro Vancouver this quarter.

Flight-to-quality, hybrid work, and new construction continue to drive vacancy rate:

As we’ve mentioned in previous quarterly updates, there are several factors negatively influencing Vancouver’s vacancy rate as we continue to adjust to new working models post-pandemic.

There is a broad consensus among market watchers that many of these key factors are still present and disrupting the market, including the flight-to-quality, hybrid work, and new construction.

Colliers noted that a significant amount of office space was returned to the market this quarter as business continue to adjust to a new work environment:

“Many businesses continue to optimize their office space requirements to adapt to the growing prevalence of hybrid work arrangements and the changing nature of in-office work which led to a significant portion of office space that was returned to the market as sublease options, one of the factors contributing to the vacancy rate’s growing trend.” [1]

Similarly, JLL also noted that companies continue to reassess their needs because of hybrid work models and overall daunting macroeconomic economic prospects. JLL specifically noted that many large office occupiers are exercising caution, contributing to unsteady office demand.

Flight-to-quality has been a key theme since the pandemic as companies and landlords move into higher class space to incentivize a return to work. Cushman and Wakefield noted that flight to quality continues to impact Downtown Vancouver’s vacancy rate as Class A and AAA activity accounted for more than half of the new leasing volume this quarter.

CBRE also noted that flight to quality is a key factor driving the vacancy rate:

“Downtown vacancy increased 30 bps to 11.8% this quarter, the result of tenant relocations into best in-class premises from the latest new build cycle which is set to complete in 2024.” [2]

JLL highlighted the impact of flight-to-quality on the vacancy rate, noting 680,000 sqft of positive absorption in Class A assets year over year.

“It’s evident that build-out office spaces and amenity-focused buildings are seeing the most activity and may do so for the foreseeable future.” [3]

Which industries are driving the leasing market?

Vancouver has historically been known for a strong technology sector. However, there were changes to the leading industries leasing space this quarter.

Last quarter, Cushman and Wakefield and Colliers attributed the decline in leasing activity partially to a reduced demand from the technology sector:

“The demand for office space in the Greater Vancouver Area by the technology sector has been shrinking, from a peak of 50% among all industries in Q4 2021 down to 26% as of Q2 2023.” [4]

This quarter, according to Colliers, healthcare has now overtaken technology as the leading sector in Vancouver:

“The healthcare sector has now overtaken the technology sector for the very first time in a decade this quarter as the most active industry, seeking over 560,000 square feet of office space in the GVA.” [5]

Cushman and Wakefield listed the top six key lease transactions for Q3 2023 in Metro Vancouver. It noted only one key technology sector transaction, Sage Software at 601 West Hastings, with the remainder in education, mining, and other sectors.

Similarly, in NAIBC’s list of the top 9 significant transactions for downtown Vancouver in Q3 2023, Life Works was the only technology sector transaction at 411 Dunsmuir, with the remainder in mining, insurance, and education.

Metro Vancouver office Vacancy Rates

Decreasing rents - a tenant’s market

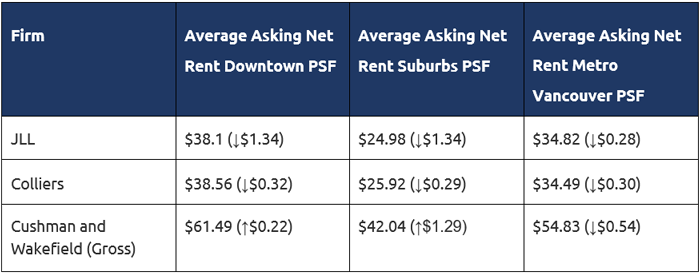

As vacancy rates stay elevated, some market watchers are noting that Metro Vancouver asking rents decreased this quarter. They analyzed what this means for tenants.

According to Colliers, Metro Vancouver net rents decreased 1% this quarter, the first decrease in three years. Colliers noted that this is positive news for tenants:

“As a result, tenants today have greater options when selecting an office and landlords are more willing to negotiate net rents, free rent periods, improvement allowances, and shorter lease terms in some cases to attract and retain occupants.” [6]

JLL also highlighted how the current economic environment is creating favourable conditions for tenants noting that there are quality opportunities available:

“Vancouver’s office market continued to move further into tenant favourable conditions, with an abundance of quality opportunities providing tenants with negotiating power not achievable during the tighter market conditions experienced over the past five plus years.” [7]

As a result, according to JLL, landlords are dropping asking rates.

It is important to note, however, that Cushman and Wakefield noted that asking rates have remained flat downtown, as new class AAA builds bit up average asking rates. Cushman and Wakefield noted that they expect downtown core asking rates to begin dropping if vacancy rates remain elevated.

Conclusion

While broader economic trends continue to impact the commercial real estate industry, this is not exclusive to Vancouver. Our market has continued to hold up better than other major markets and remains an attractive market in which to invest.

Source links:

[1] Colliers, Vancouver Office Market Report, Q3 2023

[2] CBRE, Canada Office Figures, Q3 2023

[3] JLL, Vancouver Office Market Report, Q3 2023

[4] Colliers, Vancouver Office Market Report, Q3 2023

[5] Colliers, Vancouver Office Market Report, Q3 2023

[6] Colliers, Vancouver Office Market Report, Q3 2023

[7] JLL, Vancouver Office Market Report, Q3 2023